Optimize Your Buying Power with a Jumbo Loan for High-End Residences

Optimize Your Buying Power with a Jumbo Loan for High-End Residences

Blog Article

The Influence of Jumbo Loans on Your Financing Options: What You Required to Know Before Using

Jumbo lendings can play a critical duty in forming your funding alternatives, particularly when it comes to obtaining high-value homes. Comprehending the equilibrium in between the benefits and obstacles positioned by these loans is important for possible borrowers.

Comprehending Jumbo Car Loans

Recognizing Jumbo Loans needs a clear understanding of their special qualities and requirements. Big loans are a sort of home loan that goes beyond the adapting loan limits developed by the Federal Real Estate Finance Company (FHFA) These restrictions differ by place yet generally cap at $647,200 in the majority of areas, making jumbo car loans essential for financing higher-priced properties.

One of the defining functions of jumbo fundings is that they are not eligible for acquisition by Fannie Mae or Freddie Mac, which brings about stricter underwriting guidelines. Debtors must commonly demonstrate a higher credit report, generally above 700, and offer considerable documentation of earnings and assets. Furthermore, lenders may call for a larger down payment-- frequently 20% or more-- to alleviate threat.

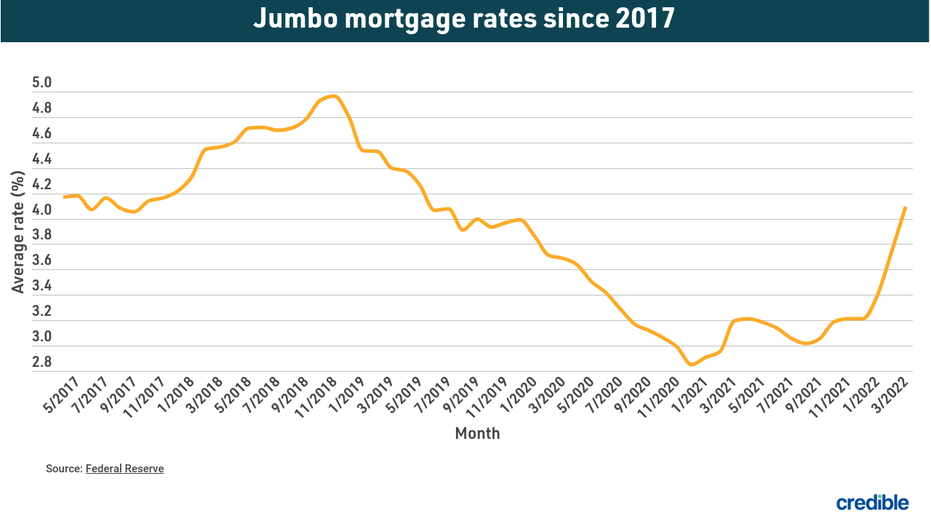

Passion rates on jumbo loans can be a little greater than those for adhering car loans because of the enhanced danger assumed by the loan provider. The lack of exclusive mortgage insurance policy (PMI) can counter some of these prices. Recognizing these elements is critical for prospective consumers, as they considerably influence the terms and feasibility of protecting a big funding in today's affordable realty market.

Benefits of Jumbo Financings

Jumbo loans supply distinct advantages for buyers looking for to acquire high-value buildings that surpass conventional finance limitations. Among the main advantages of jumbo loans is their ability to finance bigger amounts, permitting purchasers to get homes in costs markets without the constraints imposed by conforming loan restrictions - jumbo loan. This adaptability allows homebuyers to check out a broader variety of residential properties that may better suit their requirements and choices

In addition, big loans commonly include affordable rates of interest, especially for borrowers with solid debt profiles. This can result in substantial cost savings over the life of the financing, making homeownership a lot more inexpensive in the future. Moreover, big financings can be customized to fit private economic scenarios, supplying various terms and amortization choices that straighten with the borrower's purposes.

Challenges of Jumbo Lendings

Browsing the intricacies of big loans provides several challenges that possible consumers must be mindful of prior to continuing. One considerable obstacle is the stringent loaning standards enforced by banks. Unlike adapting car loans, jumbo financings are not backed by government-sponsored enterprises, leading lending institutions to adopt even more strenuous criteria. This commonly consists of greater credit report rating requirements and substantial paperwork to verify earnings and assets (jumbo loan).

In addition, big financings usually include greater rate of interest compared to traditional fundings. This raised cost can considerably impact regular monthly payments and overall affordability, making it necessary for debtors to very carefully analyze their monetary circumstance. The down payment needs for big fundings can be considerable, frequently ranging from 10% to 20% or even more, which can be a barrier for several possible homeowners.

One more difficulty hinges on the minimal availability of big finance items, as not all lending institutions provide them. This can bring about a decreased pool of options, making it vital for customers to perform detailed study and possibly seek specialized lending institutions. Generally, understanding these obstacles is essential for anyone taking into consideration a jumbo financing, as it makes certain informed decision-making and better monetary planning.

Qualification Standards

For those considering a jumbo financing, satisfying the credentials standards is an essential action in the application procedure. Unlike standard loans, jumbo car loans are not backed by government companies, resulting in more stringent requirements.

First of all, a solid credit report rating is vital; most lending institutions need a minimal score of 700. Additionally, debtors are commonly expected to demonstrate a significant revenue to guarantee they can conveniently take care of greater regular monthly settlements.

Deposit requirements for jumbo lendings are also substantial. Customers need to anticipate putting down at the very least 20% of the residential or commercial property's acquisition cost, although some loan providers may use alternatives as reduced as 10%. In addition, showing money books is essential; loan providers frequently require proof of adequate fluid assets to cover several months' worth of home loan repayments.

Comparing Funding Choices

When evaluating funding alternatives for high-value buildings, recognizing the distinctions between numerous funding kinds is vital. Jumbo car loans, which exceed conforming finance limitations, typically featured more stringent qualifications and greater rate of interest than conventional car loans. These lendings are not backed by government-sponsored business, which raises the lender's threat and can cause more rigid underwriting standards.

In contrast, standard loans use even more adaptability and have a peek here are often simpler to acquire for borrowers with solid debt accounts. They may feature lower interest prices and a broader range of choices, such as taken care of or adjustable-rate home mortgages. In addition, government-backed loans, like FHA or VA fundings, supply chances for reduced deposits and more forgiving credit history requirements, though they likewise enforce limitations on the funding quantities.

Conclusion

Finally, jumbo fundings present both continue reading this possibilities and challenges for possible homebuyers seeking financing for high-value buildings. While these fundings enable bigger quantities without the worry of exclusive home loan insurance coverage, they come with rigorous credentials needs and possible drawbacks such as greater rate of interest. An extensive understanding of the advantages and challenges connected with big loans is essential for making informed choices that line up with lasting economic goals and purposes in the property market.

Report this page